Spark Advisory – Gaining Efficiencies through Portal use with Clients and Mastering the use of Integrations!

|

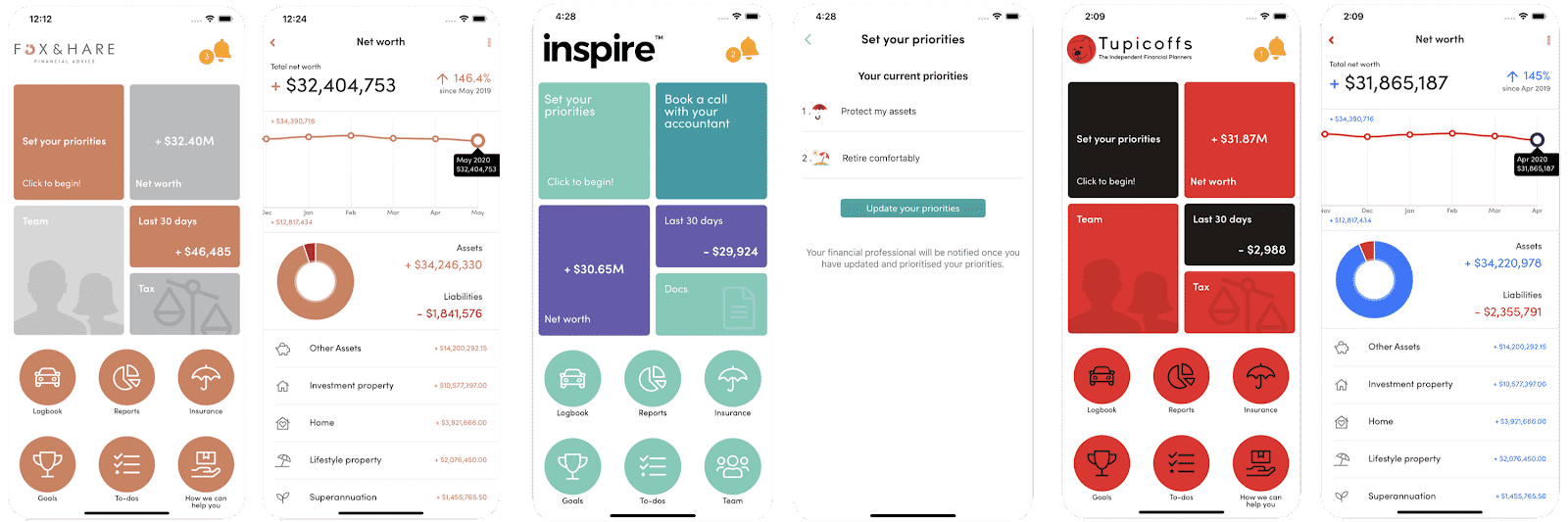

When Arthur Kallos from Spark Advisory decided to review client portals, his main objective was to provide a more secure hub for sharing information with clients. “We wanted to provide our clients with a secure method to share confidential and sensitive information with confidence”. Furthermore, being a progressive boutique firm the availability of having a branded portal and mobile App created a deeper connection with their clients, adding value through the functionality of the wealth portal. Arthur aligned the organisation strategy and values to the role of the branded app to get buy-in from his staff. “The training and resources are fantastic, but most effective for our change management was the actual efficiency gains across the practice – they are real“. All the staff have a login to the practice portal and have been assisted by both the myprosperity training team and Spark’s dedicated account manager. Integrations:Arthur and his team started by using the Xplan integration for client preparation and client review processes. The adoption for clients was mandatory, using Xplan data, IPS in the back end and myprosperity for the front end experience for clients. Reduced double handling of data between the systems was primary focus, but additional functionality and benefits such as client privacy and security, e-signatures and document storage. “myprosperity has tremendously evolved over the last three years, the Xplan integration was the turning point for bringing in even further efficiencies in our processes”. Arthur and the team collect data from new prospect clients using their Spark wealth portal and a digital questionnaire then review the data with clients in meetings. Data is easily amended on the way in, finalising the fact find and then pushing the data straight into Xplan once clients have e-signed the fact find. The team also has a digital Risk Tolerance Questionnaire and an Insurance Needs Analysis Template in their portal that can be distributed to clients efficiently. “The BEST and MOST simple item is the free hand text sections in these documents to write client file notes and elaborate further, which then the clients signed off with their e-signature”. Stats:Arthur and his team are now completing a client review easily under 60 minutes with all compliance documents complete. Arthur mentions that clients love that they can access everything in one place, especially through the mobile app, because they are always on their phones. Clients are all accepting the mandatory portal and app as Arthur and the team go through the review process. The clients engage in the tool during the review experience, attain their documents via the doc storage, witness the wealth portal feeds in action, and e-sign docs. “You can’t convert clients in one go, it’s a journey, our clients have to participate in using the portal and app to collaborate with us and access important information.” In summary, Arthur comments on the latest news of HUB24 acquiring myprosperity “I can see the benefits of this transaction, and I wish all the best with what is to come from this – if consumers engage more with their wealth and take control of their futures, then all win”.

|

Karolina Kuszyk (KK)

Head of Wealth at myprosperity

Karolina brings over 15years experience in the Tech industry. Her previous role as a Field Partner Manager at MYOB, paved her way into the FinTech space. She joined myprosperity as employee number 8 and has played an instrumental role in driving growth since.

Recent Comments